Tweet [1]

When I was younger, everyone knew that the New Deal had saved the US economy from the ravages of the Great Depression. Everyone knew that Keynes was right–look what had happened when Roosevelt implemented his ideas–the Great Depression ended! Eventually, everyone knew that story was false. The New Deal wasn’t that big and the Great Depression didn’t really end when the New Deal was implemented.

Now everyone knows that World War II ended the Great Depression. Of course, private consumption fell during WWII and the vaunted Keynesian multiplier seemed to only work for the defense industry. Someday, perhaps, people will understand that when a war takes over most of the industrial sector, you don’t get much stimulus. And it’s not hard to reduce unemployment when you force a huge chunk of the male working-age population into the army.

When the war ended, all the Keynesians predicted disaster and a horrible depression because of the cuts in government spending and men coming home from Europe and the Pacific. Well, when that didn’t happen, people should have known that there isn’t a simple relationship between government spending and prosperity. But somehow, people didn’t learn that lesson. And everyone forgot about it. (If you’re interested in how people maintained a belief in a theory that had been entirely discredited by events, you can read my earlier observations, here [2].)

How does it come to pass that everyone comes to know something that isn’t true? A simple answer is that if enough people treat it as true and those people have some credibility, then most people will assume it is true.

Which brings me to John Cassidy’s recent New Yorker piece, It’s Official: Austerity Economics Doesn’t Work [3]. HT: JoshDoody [4]) It’s been recommended by 17K people on Facebook. Over 2000 people have tweeted on it. The New Yorker is a fine magazine. I’m sure those 19,000 people and the other thousands who found the article believe that if something is in the New Yorker, it is probably true, especially if it confirms your other views. They will join the millions of people who know that reducing government spending is a bad idea when you’re running large deficits.

But just in case some of those people find their way here, I thought it might be worthwhile to examine Cassidy’s analysis. Is it official? Is austerity economics a failure?

Here’s how Cassidy’s piece begins:

With all the theatrics going on in Washington, you might well have missed the most important political and economic news of the week: an official confirmation from the United Kingdom that austerity policies don’t work.

In making his annual Autumn Statement to the House of Commons on Wednesday, George Osborne, the Chancellor of the Exchequer, was forced to admit that his government has failed to meet a series of targets it set for itself back in June of 2010, when it slashed the budgets of various government departments by up to thirty per cent. Back then, Osborne said that his austerity policies would cut his country’s budget deficit to zero within four years, enable Britain to begin relieving itself of its public debt, and generate healthy economic growth. None of these things have happened. Britain’s deficit remains stubbornly high, its people have been suffering through a double-dip recession, and many observers now expect the country to lose its “AAA” credit rating.

Unfortunately, this is the only data in the article and it’s pretty strange data. Which data am I referring to? The fact that in June of 2010, Cameron “slashed the budgets of various government departments by up to thirty per cent.” That’s the official confirmation that austerity doesn’t work. If you slash the budgets of “some government departments” and you still get a recession, that confirms that austerity isn’t good for the economy.

That’s like a guy who drinks too much wine, beer and scotch every day claiming he’s not an alcoholic anymore because he reduced his consumption of some varieties of wine by up to 30%. Wouldn’t you want to pay attention to his overall consumption of alcohol? Some government department budgets were reduced by up to 30%? What happened to overall government spending? Cassidy never tell us. There are no data in the article about the overall level of spending in the UK. Cassidy continues:

One of the frustrations of economics is that it is hard to carry out scientific experiments and prove things beyond reasonable doubt. But not in this case. Thanks to Osborne’s stubborn refusal to change course—“Turning back would be a disaster,” he told Parliament—what has been happening in Britain amounts to a “natural experiment” to test the efficacy of austerity economics. For the sixty-odd million inhabitants of the U.K., living through it hasn’t been a pleasant experience—no university institutional-review board would have allowed this kind of brutal human experimentation. But from a historical and scientific perspective, it is an invaluable case study.

Cassidy continues:

At every stage of the experiment, critics (myself included) have warned that Osborne’s austerity policies would prove self-defeating. Any decent economics textbook will tell you that, other things being equal, cutting government spending causes the economy’s overall output to fall, tax revenues to decrease, and spending on benefits to increase. Almost invariably, the end result is slower growth (or a recession) and high budget deficits. Osborne, relying on arguments about restoring the confidence of investors and businessmen that his forebears at the U.K. Treasury used during the early nineteen-thirties against Keynes, insisted (and continues to insist) otherwise, but he has been proven wrong.

If decent economics textbooks teach their students that “cutting government spending causes the economy’s overall output to fall, tax revenues to decrease, and spending on benefits to increase,” and “the end result is slower growth (or a recession) and high budget deficits” then we should be using the indecent ones. Because there’s no conclusive evidence or natural experiment to support that view.

After mentioning how important it is for Americans to learn the lesson that the UK has now learned, Cassidy continues:

Just like the Bush Administration (2008) and the Obama Administration (2009), Gordon Brown’s Labour government had introduced a fiscal stimulus to help turn the economy around. G.D.P. was growing at an annual rate of about 2.5 per cent. Once Osborne’s cuts in spending started to be felt, however, things changed dramatically. In the fourth quarter of 2010, growth turned negative and a double-dip recession began. So far, it has lasted two years. While G.D.P. did expand in the third quarter of this year, the Office of Budget Responsibility, an independent economic agency that Osborne set up, has said that it expects another decline in the current quarter. For 2013, the O.B.R. is forecasting G.D.P. growth of just 1.3 per cent. With the economy so weak, the O.B.R. says that the unemployment rate will tick up from eight per cent to 8.2 per cent next year.

That austerity has led to recession is undeniable.

But Cassidy does not give the reader any actual data on those budget cuts of Osborne’s that undeniably caused the recession other than to say that some departments were cut by 30%. So let’s take a look at what actually happened.

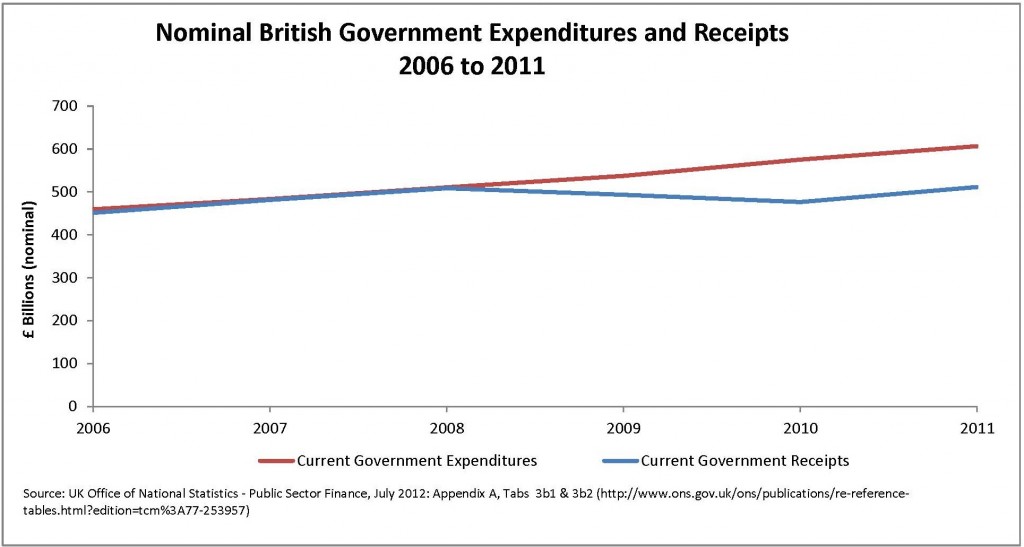

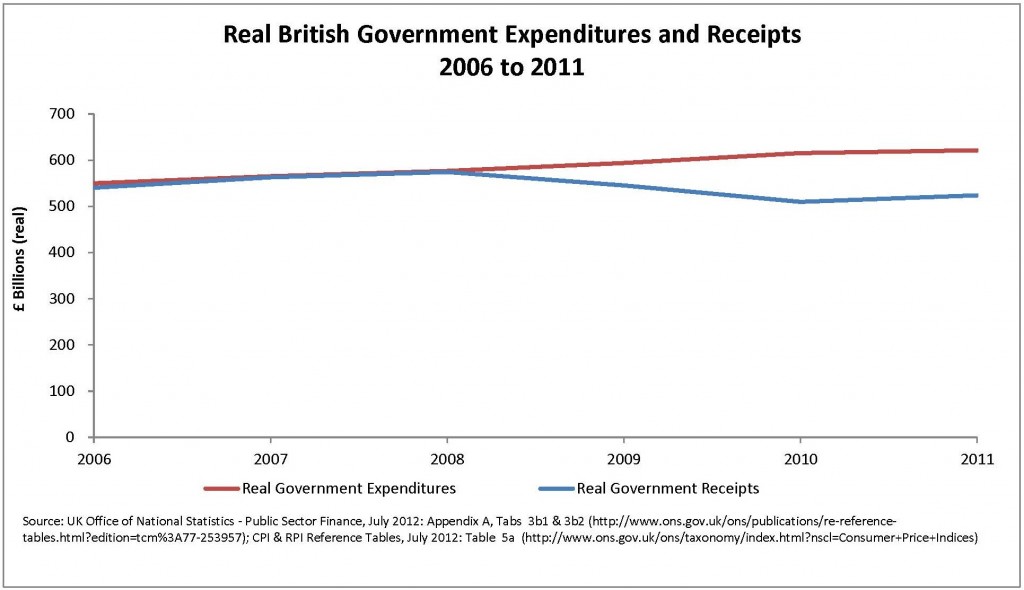

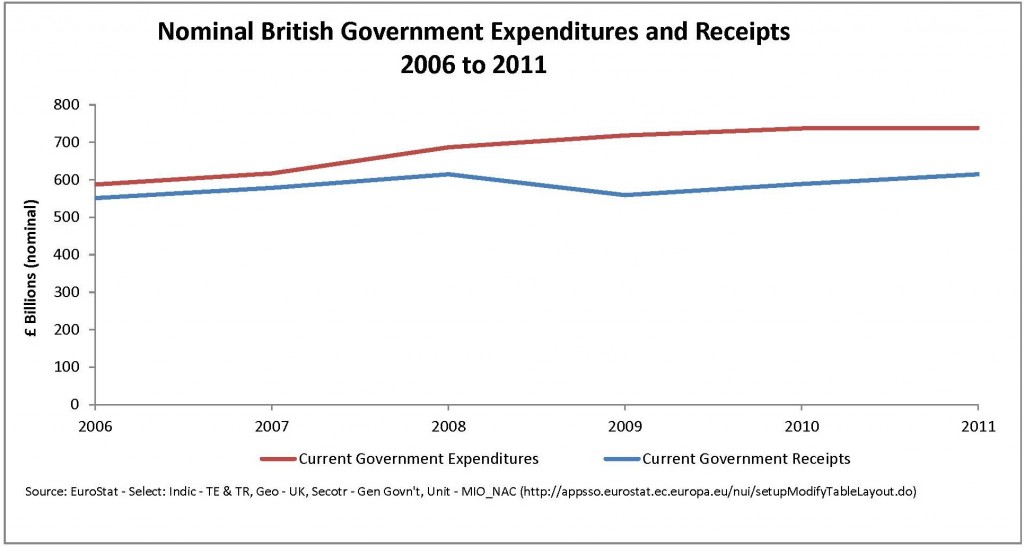

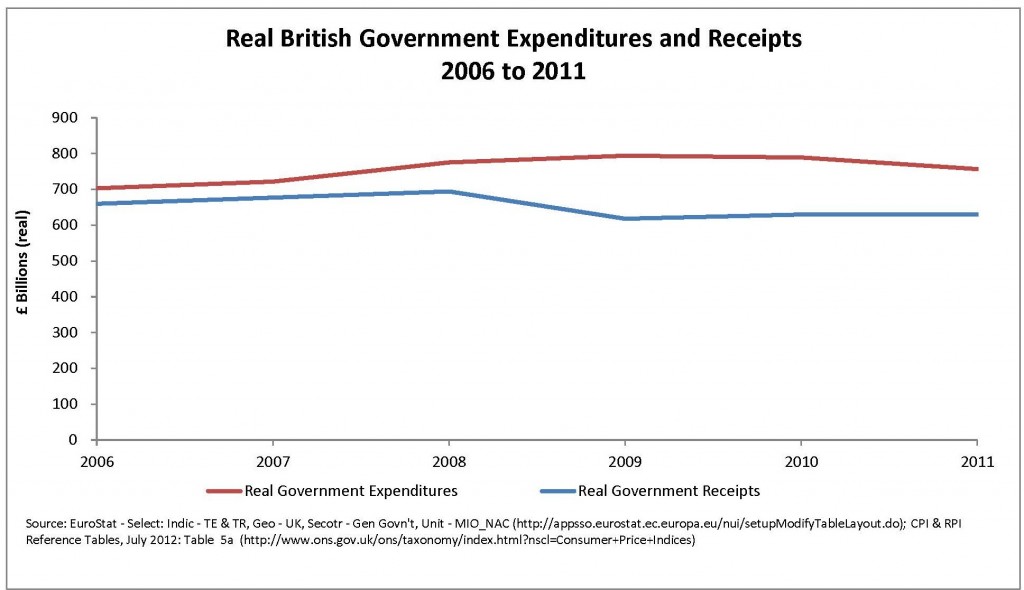

I am not an expert on UK economic data so I’m going to give you the two sources I know about, the UK’s Office of National Statistics (ONS) and Eurostat. If there are better or more accurate sources I would love to hear from someone who know UK data better than I do. And I’ll give you both nominal and real data. I would normally prefer real to nominal but I’ve heard that Keynesians say that nominal spending is what counts for measuring stimulus. So I’m giving you both. Thanks to Carson Bruno my research assistant for digging up the numbers and drawing the graphs. So take a look and tell me about those frightful budget cuts of Osborne’s in 2010, those brutal budget cuts that toyed with the lives of millions.

Scroll down to the bottom of this post and look at the red lines which are government expenditure.

There is no reduction in nominal spending in either the Eurostat or ONS data. So no nominal austerity.

In real terms, the Eurostat data show a slight drop in 2010. Less than 1%. Let me write that again. Less than 1%. That’s the austerity that plunged the UK into a double-dip recession according to Cassidy and provided the natural experiment that makes our understanding of austerity official. In 2011, according to Eurostat, real spending fell 4.1%.

Draw your own conclusions.

And of course, these changes in government spending are not the only things that are changing in the world. As Jeffrey Sachs writes in the Financial Times [5]:

And the UK’s slowdown has more to do with the eurozone crisis, declining North Sea oil and the inevitable contraction of the banking sector, than multiyear moves towards budget balance.

Mr. Cassidy has helped his readers know something that probably is not true. There has either been no austerity in the UK or at best, very little. There is no natural experiment here.

Here are the charts from ONS (nominal and real) and Eurostat (nominal and real):

[6]

[6]

[7]

[7]

[8]

[8]

[9]

[9]