Phil Magness warns of the tariff time-bomb ticking within the one big beautiful bill. Three slices:

President Donald Trump secured the first major legislative victory of his term with the adoption of the “One Big Beautiful Bill” Act, a multi-trillion-dollar spending package intended to codify his budgetary priorities. The measure contained a small victory for American taxpayers by forestalling the expiration of a 2018 income-tax cut this year. At the same time, fiscal hawks had much to criticise about the exorbitant new spending provisions, which are projected to accrue at least US$3 trillion in additional budget deficits over the next decade. The bill also contain a US$5 trillion increase in the national debt limit, removing a legislative constraint on government borrowing and setting the US national debt on track for an expansion to over US$41 trillion.

…..

The White House has been quick to tout tariff revenue as the centrepiece of its plan to pay for its spending priorities. Just last week, Treasury Secretary Scott Bessent announced in a cabinet meeting that he expects tariffs to generate US$300 billion in new tax revenue in 2025 alone. White House talking points have suggested that future tariffs will exceed even their already optimistic revenue projections in the years that follow, reversing Bessent’s widely- mocked claim from a month ago that “tariffs are not taxes:’ As it stands now, new tariff revenue comprises the single largest source of deficit offsets in the White House’s ten-year budget projections, far exceeding any discretionary spending reductions.

…..

If the IEEPA tariffs are voided by the courts, the One Big Beautiful Bill’s underlying fiscal assumptions effectively collapse. Trump would then face an accelerated budget deficit crisis with no good options to bring it under control. He could attempt to raise taxes, reneging on a campaign promise not to do so and pursuing a course that would almost certainly harm his party in the 2026 midterms. Alternatively, he could attempt to finance his spending by taking on more debt-a precarious move given that the Federal Reserve’s own toolbox to counter inflationary pressures from government spending is already stretched to its limits after the Biden era.

The appellate courts may defy expectations, though, which could mean that the Trump IEEPA tariffs somehow survive the current challenge. The administration would no doubt treat such an outcome as a victory, but such a scenario would only delay the tariff time bomb. By linking his spending agenda to tariff revenue, Trump has also limited his future options in both spending and tariff-setting.

Trump’s tariff agenda has been plagued by conflicting and contradictory messaging since he unveiled it in the spring. But one of the policy’s selling points was the promise of negotiating leverage with other countries. Trump continues to use the threat of tariffs as a tool to pull other countries into reciprocal trade “deals” with the United States, most of which amount to informal agreements with him personally. The results of this approach have been underwhelming so far, yielding just three agreements during the ninety-day pause on the “Liberation Day” tariffs from April. Yet Trump continues to hold out trade negotiations as a lure for his foreign-policy objectives.

But at least we Americans will depend less on foreigners for our tomatoes.

Wall Street Journal columnist Jason Riley is correct: With the approach of July 4th, 2026, Americans’ eyes and ears will be bombarded with mind-damaging projectiles from the “1619 Project,” a bizarre fictional tale that’s peddled as factual by benighted ideologues. A slice (link added):

It would be tempting to ignore the “1619 Project” altogether, but over the past half-decade there has been a concerted effort to mainstream the paper’s false history. Ms. Hannah-Jones was awarded a Pulitzer Prize for the project, which was adapted for a television miniseries—produced by Oprah Winfrey. This propaganda has also infiltrated K-12 schools. The National Education Association, the nation’s largest teachers’ union, formed a partnership with the Times to distribute copies of the “1619 Project” to educators and activists to “help give us a deeper understanding of systemic racism and its impact.”

The good news is that serious scholars have been pushing back. In a new book, “The 1619 Project Myth,” economic historian Phillip Magness dissects the claim that slavery was an economic boon for the nation as a whole and not just for the small population of slaveowners. The idea that plantation slavery propelled the U.S. economically was first put forward by secessionists in the antebellum South.

“Confederate secessionists invented ‘King Cotton’ as part of a pro-slavery propaganda campaign around the eve of the Civil War as an attempt to lure foreign allies to their cause,” Mr. Magness writes. “The war itself disproved the ‘King Cotton’ premise, as foreign powers simply turned elsewhere for their cotton supply and the Confederacy collapsed in economic isolation from the world.”

Another economist Mr. Magness cites, Deirdre McCloskey, has written that “each step in the logic of the King Cotton historians is mistaken.” Slavery “made a few Southerners rich; a few Northerners, too. But it was ingenuity and innovation that enriched Americans generally.” Contrary to “1619 Project” claims, “Britain in 1790 and the U.S. in 1860 were not nationalized cotton mills.” Both countries “would have become just as rich without the 250 years of unrequited toil. They have remained rich . . . even after the peculiar institution was abolished, because their riches did not depend on its sinfulness.”

If you’re looking for a thoughtful response to the 1619 nonsense that is likely to be regurgitated in the runup to next year’s celebration, Mr. Magness’s collection of essays is a good place to start.

Ramesh Ponnuru warns Democrats and progressives of the dangers of attacking the courts. A slice:

Whatever merit progressive proposals to contract the power and prestige of the Supreme Court might have, they are not a plausible means of restoring it to its former role as the champion of liberal principles. A court with reduced jurisdiction, whose members fear removal by the political branches and whose decisions command little respect from the broader political culture: That’s not an institution that can perform what Jackson recently called “the singular function of ensuring compliance with the Constitution” and “protecting people’s rights.”

A high regard for the court is particularly important now that progressives have (rightly) made it a priority to make Trump follow court orders. They can argue that the court is illegitimate or that Trump has a high duty to obey it. They seem unlikely to persuade the public that Trump has a solemn obligation to comply with an illegitimate court.

Iain Murray exposes the economic ignorance that enables people to embrace socialism. Two slices:

“Socialism,” said the British free speech campaigner Lord Young, “Always begins with a universal vision for the brotherhood of man and ends with people having to eat their own pets.” While exaggerated, the point stands — socialism never delivers what it promises. Yet now, the world capital of capitalism is flirting with that catastrophe. The Democratic nomination for Mayor of New York has been won by an avowed socialist: Zohran Mamdani.

Mamdani doesn’t hide his socialism. It’s all over his campaign website, the socialist magazine Jacobin hails him as one of their own, and he is comfortable with socialist shibboleths like “seize the means of production.”

…..

In 2020, when it seemed plausible that Bernie Sanders might win the Democratic nomination for President on a socialist platform, I wrote a book called The Socialist Temptation that attempted to answer this question.

My answer was that political communication is at heart about values, not about policy analysis. If the politician can connect with a voter at the level of their motivating values, then they have won the battle, and the most vigorous political debates are between competing values.

One of the reasons why socialism never seems to die is that it plays a very good game at connecting with people at the values level. In America, research suggests that there are three main values groups active in politics. While political scientists have fancier names for these groups, I summarize those groups as egalitarians, whose motivating value is fairness, libertarians, whose motivating value is freedom, and traditionalists, whose motivating value is community, stability, and order. (There is a fourth value group, fatalists, whose value is essentially survival, but they tend not to vote.)

My intrepid Mercatus Center colleague, Veronique de Rugy, applauds a rare and encouraging rollback of government handouts. A slice:

I want an end to all private-sector subsidies. If your business model depends on special treatment in the tax code, then, as economist Douglas Holtz-Eakin once put it, you don’t have a business. You have a tax shelter.

Yes, there are some lingering fossil fuel subsidies on the books. Cato’s Adam Michel helpfully identifies them: credits for enhanced oil recovery, for marginal wells and for carbon capture and sequestration. These are targeted giveaways, and they should also go.

However, what most people clamoring for the end of fossil fuel subsidies are pointing to aren’t subsidies at all but simply neutral tax treatments — like expensing and percentage depletion — that apply across many industries. They might distort investment decisions in general, but they are not special favors for oil and gas.

In addition, when you compare the size of green versus fossil fuel subsidies, the difference is staggering. Scaled by energy output, green energy receives subsidies at rates 19 to 30 times those of coal, oil and natural gas. According to Michel’s analysis, 94% of the fiscal cost of energy-related tax provisions over the next decade — $1.2 trillion — would have gone to renewables. Only 6% — about $70 billion — would benefit fossil fuels. And again, much of that 6% isn’t tailored to fossil fuel companies; it just happens to benefit them.

GMU Econ alum Dominic Pino talks about business with David Bahnsen.

Good to be reminded of Tucker Carlson’s dodgy views.

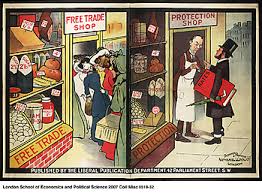

A nation that contains firms that are operating (as a whole or to some extent) only because they are protected by tariffs from competing foreign sellers is a nation that is misallocating its productive resources and impoverishing itself. This is not really a debatable proposition; it’s as basic as basic economics can get. Using resources to produce outputs that have a lesser free-market value than the outputs that could have been produced by those same resources in an alternative use sacrifices wealth; the opportunity cost is greater than the value created. That’s waste.

A nation that contains firms that are operating (as a whole or to some extent) only because they are protected by tariffs from competing foreign sellers is a nation that is misallocating its productive resources and impoverishing itself. This is not really a debatable proposition; it’s as basic as basic economics can get. Using resources to produce outputs that have a lesser free-market value than the outputs that could have been produced by those same resources in an alternative use sacrifices wealth; the opportunity cost is greater than the value created. That’s waste. In commercial societies governed by the rule of law, Smith holds, the rich may have a great deal of purchasing power, but their wealth does not lead to direct authority over others since everyone stands in a market relationship with everyone else and there are generally a multitude of potential buyers, sellers, and employers.

In commercial societies governed by the rule of law, Smith holds, the rich may have a great deal of purchasing power, but their wealth does not lead to direct authority over others since everyone stands in a market relationship with everyone else and there are generally a multitude of potential buyers, sellers, and employers. [C]ompetition for resources and positions does not disappear because they are distributed politically instead of according to supply and demand. On the contrary, in capitalism we search for opportunities for mutual gain, while in economies based on distribution from the top we begin to see other groups as threats because what they take is something we do not get.

[C]ompetition for resources and positions does not disappear because they are distributed politically instead of according to supply and demand. On the contrary, in capitalism we search for opportunities for mutual gain, while in economies based on distribution from the top we begin to see other groups as threats because what they take is something we do not get.