Further, the legal precedent that Eastman relies upon involved arms sales – clearly a genuine foreign-policy issue in a way that Trump’s tariffs are not.

Editor, The American Mind

Editor:

Criticizing the U.S. Supreme Court’s ruling against Trump’s IEEPA tariffs, John Eastman asserts that Trump’s tariffs are “clearly” tools of foreign policy and, therefore, constitutional even without Congressional delegation (“The Tariff Wears Two Hats: What the SCOTUS Majority Overlooked,” February 24). Given that Mr. Eastman’s conclusion rests entirely on the assertion that Trump’s tariffs are “a tool of foreign policy,” it’s reasonable to expect that Mr. Eastman would have attempted to justify that assertion. But he doesn’t, beyond describing the revenues raised by the tariffs as being only “incidentally” related to the tariffs – a description, not incidentally, at odds with the White House’s own many boasts about the centrality of these revenues to the president’s economic policies.

Had Mr. Eastman attempted to demonstrate, rather than merely assert, that Trump’s tariffs are tools of foreign policy, he would have failed.

Because import tariffs are by their nature levies that affect domestic demands for foreign-supplied goods, tariffs affect foreign countries. This fact was as well known in the 18th century as it is in the 21st. And yet the drafters of the Constitution chose to invest the power “To lay and collect Taxes, Duties, Imposts and Excises” and “To regulate Commerce with foreign Nations” in Congress.

Even if Mr. Eastman is correct that Article II of the Constitution gives the president a “plenary and exclusive power” over foreign policy – and even if this power includes the imposition of tariffs – the mere fact that tariffs have effects on foreign countries clearly isn’t sufficient to give the president what Mr. Eastman supposes it gives, namely, unchecked power to impose tariffs as long as the president claims, or can be presumed to claim, that his tariffs have foreign-policy purposes of the sort that the framers had in mind when they wrote Article II.

To swallow Mr. Eastman’s argument requires that we take the framers to have made no real, meaningful distinction between the foreign-policy powers that the Constitution gives to the president, and the power to impose duties, imposts, and excises, as well as to regulate commerce with foreign nations, that it gives to Congress. After all, absent such a substantive distinction, all the president must do to seize Congress’s power to levy tariffs and regulate international commerce is to mutter “foreign policy.”

That the framers carefully distinguished, as they did, the powers of the legislature from those of the executive implies that they understood that the mere fact that tariffs, as well as regulations of international trade, have effects on foreign countries is not sufficient to turn these commercial measures into foreign-policy measures.

So what of the substance of Trump’s tariffs? Is it plausible that the president imposed these duties chiefly for purposes of foreign policy rather than for domestic commercial reasons? No.

As already noted, the administration repeatedly boasted that these tariffs are a key tool for raising revenue. In addition, the White House also repeatedly insisted that these tariffs are vital measures for increasing domestic manufacturing output and employment. Neither of these goals is classifiable as “foreign policy” unless everything the government does is classifiable as “foreign policy.”

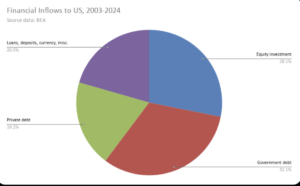

Another prominent – indeed, the predominant and express – goal of the tariffs is to reduce America’s goods trade deficits with each of the individual countries with which Americans trade. Uninformed people might assert that these bilateral goods trade deficits pose foreign-policy risks – but so, too, might uninformed people assert that foreign-policy risks are posed by income inequality, gay marriage, the legality of alcohol, free wi-fi, rap music, processed foods, and carbon emissions. More than mere assertion is necessary. And when one becomes informed about trade, one understands that the very concept of “bilateral goods trade deficits” is economically meaningless.

If courts are to allow the president to justify the imposition of tariffs as foreign-policy measures, they should require that the president do so expressly, substantively, and in a way that clearly distinguishes foreign-policy tariffs from the commercial ones that are envisioned by Article I of the Constitution. Even if we ignore the president’s threat to raise tariffs on the grounds that he was not awarded the Nobel Peace Prize, President Trump did not come close to meeting this requirement.

Mr. Eastman’s criticisms of the Learning Resources ruling all fail.

Sincerely,

Donald J. Boudreaux

Professor of Economics

and

Martha and Nelson Getchell Chair for the Study of Free Market Capitalism at the Mercatus Center

George Mason University

Fairfax, VA 22030

Fix prices — and the problems will multiply; let prices find their own level in free markets — and the problems will disappear.

Fix prices — and the problems will multiply; let prices find their own level in free markets — and the problems will disappear. For most of us, it is only with age, if ever, that we acquire the wisdom to be content to live under always imperfect rules that still permit us imperfect men to make our own imperfect decisions, with consequences for each man and for all men that no one can fully predict and that will always be something less than the New Jerusalem.

For most of us, it is only with age, if ever, that we acquire the wisdom to be content to live under always imperfect rules that still permit us imperfect men to make our own imperfect decisions, with consequences for each man and for all men that no one can fully predict and that will always be something less than the New Jerusalem. Many critics of CBA [cost-benefit analysis] seem driven by a gut feeling that CBA is heartless. They think that by denouncing CBA, they take a stand against heartlessness. In truth, weighing a proposal’s costs and benefits does not make you a bad person. What makes you a bad person is ignoring costs – costs you impose on others. Problems arise not when regulators take costs and benefits into account, but when they neglect to do so.

Many critics of CBA [cost-benefit analysis] seem driven by a gut feeling that CBA is heartless. They think that by denouncing CBA, they take a stand against heartlessness. In truth, weighing a proposal’s costs and benefits does not make you a bad person. What makes you a bad person is ignoring costs – costs you impose on others. Problems arise not when regulators take costs and benefits into account, but when they neglect to do so.