Writing in the Wall Street Journal, Phil Magness explains that section 122 of the Trade Act of 1974 – the legal authority that Trump is now trying to use as the basis for re-instituting tariffs – is not lawfully available for this purpose. A slice:

The White House’s tariff Plan B looks copied from President Biden’s playbook when the court overruled his student-loan forgiveness scheme in 2023 and Mr. Biden began statute shopping for anything to back it. That strategy hit a roadblock in federal court, as a succession of rulings invalidated his attempt to revive the policy under different laws.

The same may happen to Mr. Trump. His plan relies on a seldom-invoked clause of the Trade Act of 1974, Section 122. It allows the president to impose a general tariff of up to 15% for 150 days to address “fundamental international payments problems” that “require special import measures to restrict imports.”

Under Mr. Trump’s current interpretation, this law allows tariffs in the presence of a common trade deficit, which occurs when a country imports more goods and services than it exports. The U.S. has run trade deficits for most years since the mid-1970s. But Mr. Trump’s reading of Section 122 is erroneous. The relevant statute allows only tariffs that “deal with large and serious United States balance-of-payments deficits,” “prevent an imminent and significant deprecation of the dollar,” or facilitate an international agreement to correct a “balance-of-payments disequilibrium.” To justify his new tariffs, Mr. Trump is relying on the first option and now asserts the U.S. has a large balance-of-payments deficit.

But that’s different from a trade deficit. Turning to the arcane economic terminology of international accounting, the balance of payments is a complete ledger of all economic transactions between the U.S. and the rest of the world. The trade balance, also known as the current account, comprises only a part of this ledger.

Other components appear in the capital and financial accounts, which cover monetary transfers and investment transactions with the rest of the world. While the U.S. current account is in deficit, the capital account runs a large surplus, effectively balancing it out. Under this full accounting, the current U.S. balance-of-payments deficit is close to zero.

Also critical of the Trump administration’s reckless reliance on section 122 is the Editorial Board of the Washington Post. Three slices:

President Donald Trump’s first effort to replace the tariffs struck down by the Supreme Court is based on a misreading of a 1974 law that allows for temporary trade restrictions due to “large and serious United States balance-of-payments deficits.” That is not the same as the balance of trade, which is why courts would ideally enjoin the president’s proclamation.

…..

Trump’s proclamation appears to be modeled on President Richard M. Nixon’s 1971 order to impose a 10 percent blanket tariff to respond to a balance of payments problem. But the economy has changed quite a bit over the past 55 years.

Back then, the global economic system had fixed exchange rates for many currencies, and the dollar was redeemable for gold. In that world, it could make sense to restrict trade to avoid an imbalance of payments due to dwindling gold reserves. That’s why international trading rules had an exception to allow for such restrictions.

…..

Courts are supposed to interpret the words in the laws that Congress passes. The justices have made clear they are no longer expected to defer to the executive branch’s interpretations of them. “Balance of payments” doesn’t mean “balance of trade,” and there’s nothing serious about these accounting statistics for the U.S. economy.

And here’s Clark Packard and Alfredo Carrillo Obregon on the unlawfulness of Trump’s selection of section 122 as the alleged legal basis for his re-instituted tariffs. A slice:

Under the current international monetary regime of floating exchange rates, a country that does not regularly intervene in foreign exchange markets to peg its currency and does not suffer from insufficient capital inflows (such as the US) does not need to use its foreign reserves to finance an imbalance between international payments and receipts. Its currency can freely depreciate and thereby prop up its exports and domestic assets. (Milton Friedman actually proposed a floating exchange rate as a solution to balance-of-payments problems in the 1960s: “a system of floating exchange rates eliminates the balance-of-payments problem […] the [currency] price may fluctuate, but there cannot be a deficit or a surplus threatening an exchange crisis.”)

Ilya Somin, a key player in getting Trump’s IEEPA tariffs declared to be the unconstitutional infringements that they are, writes at The Dispatch about this case. A slice:

Trump’s April 2025 “Liberation Day” executive order invoked IEEPA to impose 10 percent tariffs on almost every nation in the world, plus large additional “reciprocal” tariffs against dozens of other countries. He also used IEEPA to impose 25 percent tariffs against Canada and Mexico, and 10 percent tariffs against China, supposedly justified by the flow of fentanyl into the United States from those countries. Taken together, these tariffs amounted to the highest U.S. tariff rates since the disastrous Smoot-Hawley tariffs of the Great Depression, and would have caused grave damage to the U.S. economy.

The main basis for the court’s ruling is that IEEPA does not even mention the word “tariff,” and has never been used to impose them by any previous president during the statute’s nearly 50-year history. The power to “regulate” importation, which IEEPA does grant in some situations, does not include a power to impose taxes.

But an additional crucial factor was the sheer scope of the authority claimed by Trump. As Chief Justice John Roberts noted in his opinion for the court, the president claimed virtually unlimited power to “impose tariffs on imports from any country, of any product, at any rate, for any amount of time.”

The framers of the Constitution wanted to ensure the president would not be able to repeat the abuses of English kings, who imposed taxes without legislative authorization. Under Trump’s interpretation of the law, the president would have virtually unlimited tariff authority, similar to that of an absolute monarch of the kind King Charles I aspired to be. The court decisively rejected this aspiration to unconstrained presidential power. Roberts’ majority opinion, a concurring opinion by Justice Neil Gorsuch, and one by Justice Elena Kagan (writing for all three liberal justices) all, in different ways, emphasized this aspect of the case. As Gorsuch put it, “Our system of separated powers and checks-and-balances threatens to give way to the continual and permanent accretion of power in the hands of one man. That is no recipe for a republic.”

Tim Carney decries the increasing habit of politicians, left and right, to accuse the U.S. Supreme Court as being illegitimate when it rules in ways these politicians dislike.

Here’s Wall Street Journal columnist Jason Riley on Trump’s tariffs punitive taxes on Americans’ purchases of imports. Two slices:

The Supreme Court’s decision striking down President Trump’s sweeping taxes on imports was the best thing that could have happened to Republicans in an election year when they will need all the help they can get. How long will it take the GOP to realize that?

The court ruled 6-3 that Mr. Trump overstepped his authority by using emergency powers to bypass Congress and impose tariffs on China, Canada and Mexico to address trade imbalances and stop drug smuggling. Like previous high court decisions that blocked the Biden administration’s student-loan forgiveness and eviction moratorium, the ruling strikes a blow for the constitutional separation of powers. It also provides cover to Republicans who want a course correction on tariff policy between now and November.

…..

The president insists that tariffs ultimately are paid by foreigners and are necessary to “protect our companies,” but a recent study by the New York Federal Reserve concluded what many other studies have shown—that nearly all the economic burden from the Trump tariffs has fallen on U.S. firms and consumers.

That is no surprise to anyone familiar with classical economic writings on trade going back more than two centuries. But even people who have never read a word of Adam Smith, David Ricardo or John Stuart Mill can read an electricity bill or a grocery-store receipt. Mr. Trump is less bothered by higher retail prices because he thinks they are necessary to rebalance a global economy in which the U.S. supposedly has been “ripped off” for “many decades,” even as it somehow became the most prosperous nation in human history.

Voters punished Democrats in 2024 over inflation, but Democrats have since won elections by campaigning on cost-of-living concerns. Mr. Trump wants to double down on tariffs, but that means doubling down on tax increases at a time when consumers are most worried about affordability. The president would have Republicans ignore polls on the economy, stay the course on his trade policies, and hope for the best in the fall as he tries to make mercantilism great again. It’s a fool’s errand.

Reason‘s Jack Nicastro identifies three blatantly false economic statistics that Trump boasted about in his 2026 State of the Union address. A slice:

2. In 12 months, I have secured commitments for more than $18 trillion pouring in from all over the globe.

Trump keeps making outlandish claims about the foreign direct investment supposedly fostered by the “deals” he’s brokered with his illegally imposed tariffs. Reason has debunked these claims here and here. But even the White House isn’t claiming the level of investment that Trump claimed tonight: Its website reports $9.7 trillion in total U.S. and foreign investments.

Here’s a photo taken on April 8, 2025, in Guatemala City. In it are, on the bottom left, Laura Williams; sitting on the bed is Ryan Yonk; on the couch are me and, to my left, Caleb Petitt; to Caleb’s left, standing, is Jack Nicastro; seated in the chair nearest Jack is Phil Magness; seated in the chair on the bottom right is Lenore Ealy. This photograph was taken by Brad DeVos. We were drafting – connected by telephone with David Henderson – the Anti-Tariff Declaration.

Scott Winship, with help from Jeremy Horpedahl, corrects one of the errors committed by Jeffrey Tucker in the latter’s attempt to discount the rise in ordinary Americans’ living standards over the past half-century.

The greatness of a competitive economy is that it forces constant revision of our estimates and changes in our behavior when we are mistaken. If we were omniscient, there would be no point in free enterprise or a competitive economy. Appointed officials could issue orders from on high to do the right thing, and that would be the end of it.

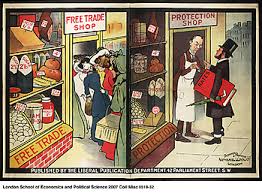

The historical record shows that countries that are more open to the world economy grow faster than those that remain closed.

The historical record shows that countries that are more open to the world economy grow faster than those that remain closed.

Those who fear that [if term limits for members of Congress were imposed] we would lose the great “expertise” that members of Congress develop after years of dealing with certain issues fail to see that much of that experience is in the arts of packaging, log-rolling, creative accounting and other forms of deception.

Those who fear that [if term limits for members of Congress were imposed] we would lose the great “expertise” that members of Congress develop after years of dealing with certain issues fail to see that much of that experience is in the arts of packaging, log-rolling, creative accounting and other forms of deception.